Tompkins disclosed ownership in holding company

Disclosure may help defense but doesn't disprove the government’s case

Sheriff Steven Tompkins disclosed his shares in an obscure limited liability company believed to be at the center of the US attorney’s corruption case against the Suffolk County official according to statement of financial interest records obtained from the State Ethics Commission.

Disclosure of the ownership does not disprove the government’s case, but might serve as a fact the defense could lean upon to claim that Tompkins had nothing to hide in his purchase of the shares.

Tompkins was indicted last month on two counts:

of illegally obtaining pre-IPO stock in Company A (widely identified as Ascend Wellness) through the purchase of $50,000 of stock in Holding Company A

obtaining a full $50,000 refund of the investment after the value of Company A collapsed

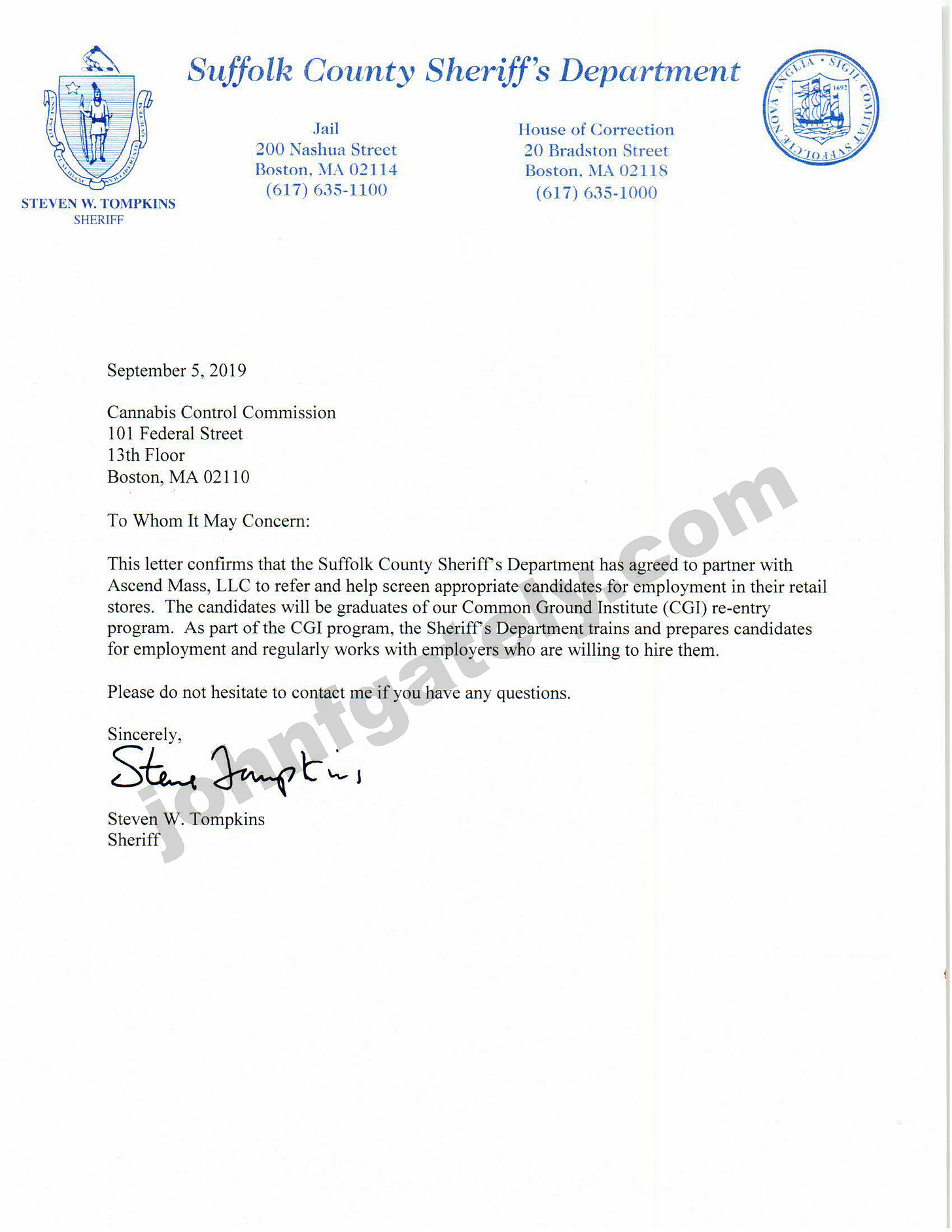

The leverage allegedly used to be included in the pre-IPO stock deal was a letter issued from the Sherriff’s Department to Ascend Wellness detailing the Department’s partnership in a required social justice component of Ascend’s application before the Cannabis Control Commission.

The indictment does not identify Holding Company A by name, but does indicate that the “sole asset” of the LLC was pre-IPO stock in Company A. Tompkins allegedly purchased the holding company stock in November 2020, after company officials rebuffed a direct purchase in Company A.

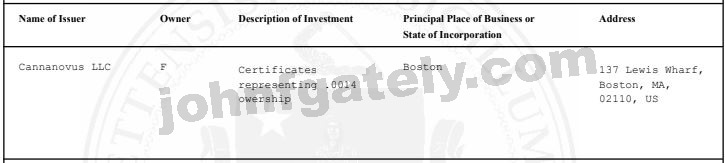

Tompkins 2020 Statement of Financial Interest includes an ownership disclosure, not included in the 2019 year report, for “Cannanovus” LLC on Lewis Wharf, Boston.

A company with the spelling “Cananovus LLC” - one less n - is also located on Lewis Wharf and controlled by Francis Perullo, a participant in several LLCs on file with the Massachusetts Secretary of State and a partner in the Novus Group. The Novus Group lists Ascend Wellness as a client.

Perullo founded Novus Group with former Boston City Councilor Paul Scapicchio.

Tompkins reported the ownership in “Cannanovus” for the calendar years of 2020 and 2021 only and the indictment alleges he was refunded the full $50,000 in five payments from May 2022 through July 2023.

The 2023 Annual Report for Cananovus LLC lists its purpose as an “investment and holding vehicle.”

The vast majority of those alleged refund payments occurred in 2022 and by the reporting date of December 31, 2022, Tompkins investment may have fallen below the $1000 state ethics commission reporting threshold.

The value of Ascend Wellness peaked in the summer 2021 at approximately $11 a share, by May 2022 shares were trading just above $3, Ascend closed 2022 at $1.15 per share. According to the indictment Tompkins bought in at the equivalent of $3.46.