Study: Commonwealth risks long-term decline as well-off households flee MA to FLA, NH

Massachusetts is one of only 12 states that imposes an estate tax

Raising the estate tax threshold could staunch the outflow of taxable income to Florida, New Hampshire and other lower tax states according to a new study by the Pioneer Institute.

“Massachusetts is bleeding capital and talent while competitor states are adding hundreds of thousands of private sector jobs,” said Jim Stergios Executive Director of Pioneer Institute. “Every month we delay reform, the gap widens—and the Commonwealth risks locking itself into long-term decline.”

Specifically, the Massachusetts estate tax kicks in at $2M, only Oregon and Rhode Island have lower thresholds. Even states often considered high tax jurisdictions, have much higher triggers, Illinois is double the Massachusetts threshold at $4M and New York is more than triple at over $6M.

In October 2023 Governor Maura Healey signed a bill raising the threshold from $1M to $2M.

In April of this year Healey said: “We know everyone is struggling with high costs, especially our seniors, and President Trump’s tariffs and cuts to essential programs are only making things worse. But here in Massachusetts, we’ve prioritized tax cuts for families, seniors, renters, homeowners and businesses to lower the cost of living.”

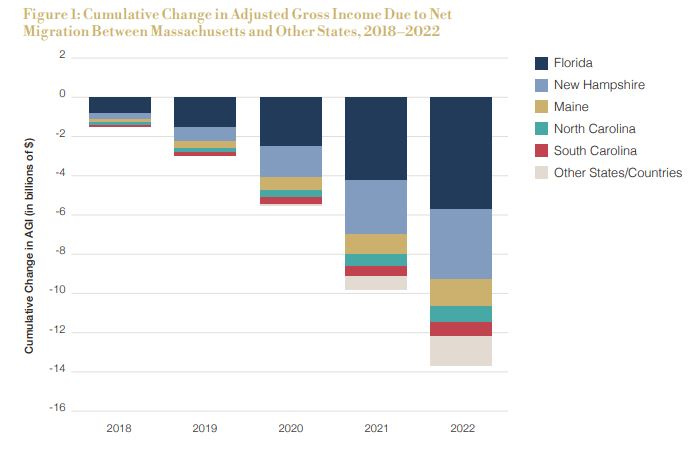

According to Pioneer, Massachusetts lost $10.7B in net adjusted gross income in the the tax years 2020, 2021 and 2022 mostly “concentrated among tax filers with at least $200,000 in yearly income.”

Barring a complete repeal of the estate tax, which is the policy in 38 states, Pioneer Institute is recommending raising the threshold to the federal level of $13.99M, as is the policy in neighboring Connecticut.

According to new the study released today, “The Case for Competitiveness: A Menu of Pro-Growth Changes to Massachusetts Corporate Tax Policy:

“Massachusetts should avoid taxing estates entirely, as most states do. The tax serves as a trap for the unwary, hitting homeowners, small business owners, and others who may not have tax advisors. Alternatively, Massachusetts should adopt the federal minimum threshold for which the tax applies, currently $13.99 million for 2025,” according to new study released today, “The Case for Competitiveness: A Menu of Pro-Growth Changes to Massachusetts Corporate Tax Policy.”

“Raising the estate tax income threshold could help stop the flow of outmigration Massachusetts is experiencing. A recent Massachusetts Society of CPAs survey indicated that 55 percent of accountants believed ‘that raising the estate tax threshold to $5 million and adjusting annually for inflation’ would be likely to deter their clients' relocation”

“Now more than ever, small businesses are operating in a hyper-competitive environment,” said Steve Clark of the Massachusetts Restaurant Association. “Every policy decision impacts profitability and growth potential. We need tax policy that encourages growth and signals to the rest of the country that Massachusetts is open for business.”