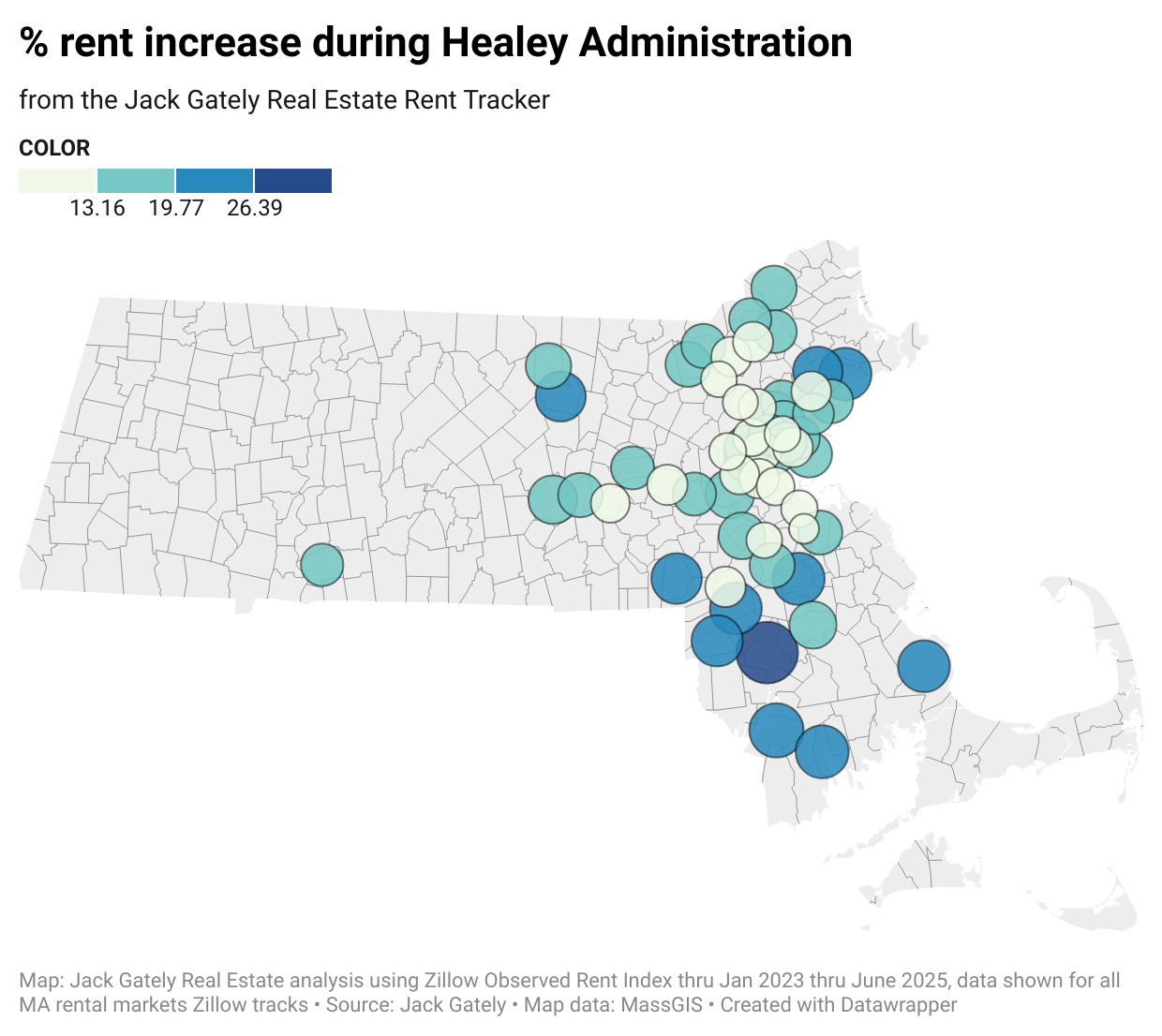

Amid widespread increases, locations outside and south of Boston/128 saw biggest rent spikes since Healey sworn in

Rents in Taunton increased 32% since Healey took office

Rents increased in every market tracked by Zillow since Maura Healey took office in January 2023 according to the Jack Gately Real Estate Rent Tracker, with locations outside and especially south of the Boston/128 belt seeing big spikes.

The Southcoast cities of Taunton, Fall River and New Bedford (all three home to new MBTA commuter rail stations) took the top three spots for biggest percentage gains.

Rents in Taunton have risen a staggering 32% since January 2023 up from $1479 to $1958.

But new MBTA service might not be the only factor driving higher rents, statewide rents are up 15% in communities tracked by Zillow in the 31 months since Healey took office. Plymouth’s only MBTA station closed in 2021 and rents have risen 22% in America’s Hometown since January 2023.

Rents in Brockton are up 22% having been served by MBTA commuter rail for years.

Several communities with pre-existing MBTA commuter rail service made the top ten for percent gains. Seven of the top ten rent hike communities were in Bristol County or Plymouth Counties.

Beverly (23%) and Leominster (20%) were the only two communities in the top ten north of the Mass Pike, both locations as well as Mansfield (22%) and Attleboro (21%) have been served by MBTA commuter rail for many years. Danvers ranked 11th just behind Leominster.

Communities experiencing the lower rates of increase were in the immediate Boston/128 region including Braintree (6%) and Burlington (9%). Needham (19%) was the biggest percentage gainer in the Boston/128 belt.

Boston rents are up 11% since Healey took office from $3002 to $3342.

Cambridge, Somerville and Brookline are the most expensive rental markets. Rents in Cambridge top out the index at $3552. Fitchburg, New Bedford and Springfield have the lowest rents.

The Jack Gately Real Estate Rent Tracker analyzes data from the Zillow Observed Rent Index a “smoothed measure of the typical observed market rate rent across a given region. ZORI is a repeat-rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for-rent. The index is dollar-denominated by computing the mean of listed rents that fall into the 35th to 65th percentile range for all homes and apartments in a given region, which is weighted to reflect the rental housing stock.”